The Lowdown on Dominican Republic Interest Rates: What You Need to Know

The Dominican Republic has a booming economy and is the Crown Jewel of the Caribbean.

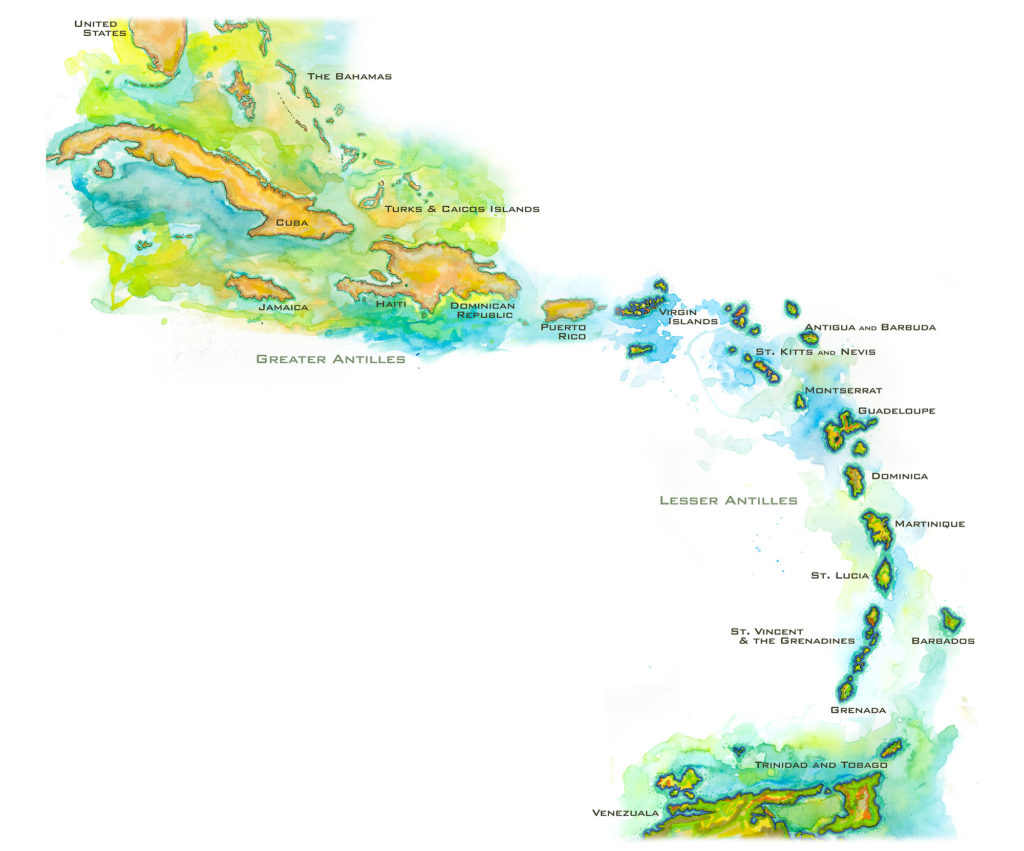

The Dominican Republic is a country located in the Caribbean region of North America. It shares the island of Hispaniola with Haiti to the west. The country has a population of approximately 10 million people and its capital city is Santo Domingo.

The Dominican Republic has a diverse landscape, including beaches, mountains, and tropical rainforests. The climate is tropical, with temperatures averaging between 75°F and 85°F (24°C to 29°C) throughout the year. The country is known for its beautiful beaches, vibrant culture, and music, especially merengue and bachata.

The official language of the Dominican Republic is Spanish. The country’s economy is driven by tourism, agriculture, and manufacturing, with tourism being the largest contributor to the GDP. The country is also known for its production of coffee, tobacco, and sugarcane.

The Dominican Republic has a rich history, having been discovered by Christopher Columbus in 1492 and later becoming the first permanent settlement in the New World. The country gained its independence from Spain in 1821 and has since experienced political instability.

Today, the Dominican Republic is a democratic nation with a president as the head of state and a unicameral legislature. The country has a diverse and multicultural population, with influences from indigenous, African, and European cultures.

Interest rates in the Caribbean can vary depending on the country and the economic conditions. Generally speaking, interest rates in the Caribbean tend to be higher than those in more developed countries, such as the United States and Europe. This is partly due to the fact that many Caribbean countries are small and heavily indebted, which can make borrowing more expensive.

Be sure to check out our great selection of properties!

In some cases, Caribbean countries have also struggled with high inflation rates, which can lead to higher interest rates as a way to control inflation. Additionally, many Caribbean countries have economies that are heavily dependent on tourism, which can make them vulnerable to economic shocks and fluctuations in demand.

For example, Dominican Republic interest rates increased by 550 points from 4.50% to 8.50 % in 2022.

However, there are also some countries in the Caribbean that have been able to maintain relatively stable economies and lower interest rates. For example, the Dominican Republic interest rates has seen a decline in recent years due to economic growth and improvements in the country’s fiscal management.

Overall, interest rates in the Caribbean can vary widely and depend on a range of factors, including economic conditions, government policies, and international trends. It is important for individuals and businesses to stay informed about interest rates in their respective countries and to seek expert advice before making financial decisions.

Whether or not you should get a mortgage in the Dominican Republic depends on your individual circumstances and financial situation. Here are some factors to consider:

- Interest Rates: Interest rates for mortgages in the Dominican Republic may be higher than in your home country, so it’s important to compare rates and terms before making a decision. You should also consider the potential impact of currency fluctuations on your monthly payments and overall costs.

2. Down Payment: Most lenders in the Dominican Republic require a minimum down payment of 20-30% of the property’s value, so you’ll need to have some savings or assets to qualify for a mortgage. Keep in mind that a higher down payment can lower your interest rate and overall borrowing costs.

3. Creditworthiness: Lenders in the Dominican Republic will evaluate your credit history, income, and other factors to determine your eligibility and loan amount. If you have a good credit score, stable income, and low debt-to-income ratio, you may be able to qualify for a larger loan or better terms.

4. Repayment Term: Mortgages in the Dominican Republic typically have shorter repayment terms than in other countries, usually ranging from 10 to 25 years. This means that your monthly payments may be higher, but you’ll pay off the loan faster and save on interest costs.

5. Rental Income: If you plan to rent out your property in the Dominican Republic, you may be able to use the rental income to cover some or all of your mortgage payments. However, you should factor in the costs of property management, maintenance, and taxes, as well as the potential risks and volatility of the rental market.

In summary, getting a mortgage in the Dominican Republic can be a viable option if you have the financial capacity, creditworthiness, and investment goals to support it. You should weigh the pros and cons, consult with a local lender or financial advisor, and make an informed decision based on your personal circumstances.

The lending interest rates have dropped significantly over the last number of years. This is one factor that allows more foreigner investment.

Things You Need To Know About Dominican Republic Interest Rates

There Is No Such Thing As A Fixed Rate Mortgage

Re-Evaluation Of Your Interest Rate Happens Every Year

Depending On The Bank, The Entire Process From Application To Delivery Of Funds Can Be 30-90 Days

Going Through A Private Lender Will Cost You More As Their Interest Rate Is Generally Much Higher

If You Pay Off The Home Loan Quickly (3-5 years) You Could Face A Financial Penalty

The #1 Question You Need To Ask Yourself About Dominican Republic Interest Rates

Because your mortgage rate is adjusted every year, are you comfortable paying a home loan with an interest rate of 10% or more? What if the rate increases to 12%? Are you comfortable paying that percentage?

Buying property in the Dominican Republic can be an exciting and rewarding experience. With its stunning beaches, vibrant culture, and warm climate, the Dominican Republic has become a popular destination for vacationers, retirees, and investors alike.

However, before you start browsing listings and booking flights, it’s important to understand the local real estate market, laws, and customs. In this blog post, we’ll cover some key things to keep in mind when buying property in the Dominican Republic.

1. Research The Market

The first step to buying property in the Dominican Republic is to do your research. Start by familiarizing yourself with the different regions, neighborhoods, and types of properties available. Determine your budget, priorities, and requirements, such as proximity to the beach or nightlife, number of bedrooms, or rental income potential.

Consult with a local real estate agent who can provide you with information about the market, property values, and the buying process. You can also check online real estate portals and classifieds, but be wary of scams and unrealistic deals.

2. Understand The Legal Process

In the Dominican Republic, real estate transactions are governed by the Civil Code and the Constitution, as well as various regulations and administrative procedures. Foreign buyers are subject to the same laws and regulations as locals, but may require additional documentation and verification.

Before signing any contracts or making payments, make sure you have a clear understanding of the legal process and your rights and obligations. Consult with a local lawyer who can help you with the due diligence, title search, and property registration, as well as provide you with advice on taxes, fees, and other expenses.

3. Get Financing And Insurance

If you need financing to buy property in the Dominican Republic, you can obtain a mortgage from local or international banks, or from private lenders. However, interest rates and terms may be higher than in your home country, and you may need to provide collateral or a down payment.

It’s also important to obtain property insurance to protect your investment from natural disasters, theft, or liability. Insurance rates may vary depending on the location, type, and value of the property, as well as your personal circumstances.

4. Plan For Maintenance And Management

Owning a property in the Dominican Republic requires ongoing maintenance and management, especially if you plan to rent it out or use it as a vacation home. You may need to hire a property manager, a cleaning service, or a maintenance crew to take care of repairs, cleaning, and upkeep.

You should also be aware of the local rules and regulations for renting out your property, such as obtaining a rental permit, collecting taxes, and complying with safety and health standards.

In conclusion, buying property in the Dominican Republic can be a great investment and lifestyle choice, but it requires careful planning, research, and preparation. By following these tips and working with a local team of professionals, you can make your dream of owning a piece of paradise a reality.

Let’s talk some more about Dominican Republic Interest Rates.

Caribbean Loan Officer

What Are Some Items You Will Need To Apply For A Mortgage?

Here are some items you will need in order to apply for a mortgage from a bank in the Dominican Republic. You will need your Social Security Card, Passport, Tax Return, Bank Statements, Driver’s License and a document stating your Credit Score In USA. Each bank will have a list of all the documents you will need, as mentioned above, this is just a short list of some items you will need.

Timeframe

After turning in all the required documentation some banks will immediately pre-approve you. Then send the documents to their legal department which will then take roughly 1 week to 2 weeks to conduct all the due diligence and return an answer of approved or rejected to you. If approved you can expect to receive the money in usually 1 week or less.

How It Works

You receive an “initial term” when you are approved for a mortgage from the bank. Example, you receive a loan with an interest rate of 8% for 1 year. Then at the end of the first year the bank re-evaluates your payment behavior and the loan according to the market. At the end of the re-evaluation process you will receive a new interest rate for a year. This process is repeated until the loan is paid off by the borrower.

There is no such thing as a fixed rate mortgage in the Dominican Republic.

From start to finish you can receive your loan typically in less than 90 days.

Typical Dominican Republic Interest Rates

All banks provide home loans in Dominican Pesos but not all banks provide home loans in US Dollars. Most banks will have a interest rate of 8% for a US Dollar loan. Scotiabank is the only bank that does not start out the loan with 8% interest rate, the interest rate is usually between 4-6% depending on the initial term.

Closing

We hope you learned something new about Dominican Republic Interest Rates and received some value from this blog. If you have any questions about how to secure a mortgage in the Dominican Republic then feel free to reach out to us here. We are putting more informative blogs like this one. The Lowdown on Dominican Republic Interest Rates: What You Need to Know, and we would love to have your feedback and questions. Feel free to drop anything you have in the comments section pertaining to Dominican Republic Interest Rates.