Caribbean Real Estate ROI Myths

*Disclaimer: This blog is so you are aware of the myths concerning ROI in unregulated real estate markets in the Caribbean. It is still important that you conduct your own due diligence of ROI on properties in regulated & unregulated markets.

Read this report about investing in Playa del Carmen.

The Caribbean real estate market can be a crazy place and it doesn’t matter if you are buying luxury Caribbean real estate or not, you need to know the right questions to ask and be provided with the most accurate information concerning the rental market.

Here is a great article about ROI that you need to read.

Let’s Jump In!

The concept of return on investment (ROI) is often used to evaluate the potential profitability of a real estate investment. However, the idea that there is a consistent, predictable ROI for real estate investments is a myth. The actual ROI for a particular investment can be affected by a wide variety of factors, including the condition of the property, the local real estate market, the cost of improvements and repairs, and the effectiveness of the property management. In addition, the ROI for real estate investments can be difficult to calculate and compare to other types of investments, due to the unique characteristics and complexity of each property.

Take A Look At This Stunning Luxury Villa In Turks and Caicos

Another point to consider is that Real Estate investing not just a short-term bet but more of long-term investment, the investors should consider many different factors and should not just focus on the ROI.

Need A Realtor In Miami? Daniel Is Your Guy!

It’s important to keep in mind that real estate investing is not a get-rich-quick scheme and it’s important to do your due diligence before making any investment. It’s also important to remember that past performance is not necessarily indicative of future results.

We Love This Miami 6 Bedroom Home

The return on investment (ROI) for real estate in the Dominican Republic & Mexico (unregulated real estate markets) can vary widely depending on a variety of factors. Factors that can affect the ROI include the location and condition of the property, the state of the local real estate market, and the costs associated with buying and owning the property.

Perfect Place to Build Your Dream Home in Turks and Caicos

In recent years, the Dominican Republic & Mexico have become an increasingly popular destination for foreign buyers, particularly in the beachfront and vacation rental market. Properties in tourist hotspots like Punta Cana and Santo Domingo can command high rental rates, which can result in a high ROI for investors. However, it’s important to keep in mind that the market for vacation rentals can be affected by fluctuations in tourism, as well as by natural disasters, political events, and other factors.

Have You Seen Our ‘Resources‘ Page? If Not Check It Out!

In addition, like any real estate investment, there’s risk involved and it’s crucial to do your research. Some investors have reported strong returns on their investments in the Dominican Republic, while others have reported difficulties in finding tenants or dealing with property management and maintenance issues. As always, it’s important to consult with a real estate professional, accountant or attorney with experience in the Dominican Republic before making any real estate investments.

Don’t forget to check out our Caribbean Property Vetting Checklist

Should I Invest In Tulum Real Estate?

7 Things To Consider

When considering buying a property, it’s important to thoroughly vet the property in order to ensure that you are getting a good deal and that there are no hidden issues that could cause problems down the road. Here are a few steps you can take to vet a property before making an offer:

* Do Your Research: Look into the property’s history, including information on the previous owners, any recent sales, and any permits or building codes that have been issued for the property.

* Inspect the Property: Hire a professional inspector to thoroughly examine the property and provide a report on any issues or potential problems. Be sure to attend the inspection and ask the inspector any questions you may have.

* Check the Neighborhood: Visit the property during different times of the day, explore the neighborhood and research the area’s crime rate, schools, public transportation, and future development plans.

* Review the Title and Survey: Hire a title company to do a title search and review the property’s survey. Look for any outstanding liens, easements or other encumbrances that could affect your ability to use the property.

* Legal and Tax Review: Consult with a real estate attorney and accountant to review the legal documents and understand the tax implications of the purchase.

* Get a building and pest inspection done.

* Look at Comparable Properties: Research the prices of similar properties in the area to ensure that the property you’re considering is appropriately priced.

By thoroughly vetting a property before you buy it, you can make an informed decision and potentially avoid costly mistakes.

Search all of our Caribbean Real Estate Here!

It’s important to remember that you should not rush the process of purchasing a property and even after the due diligence process is completed, the property may have additional issues that could only be identified once the ownership is transferred.

Take a Look At this Beautiful 4 Bedroom Villa In Turks and Caicos

Property Vetting Tips & Warning

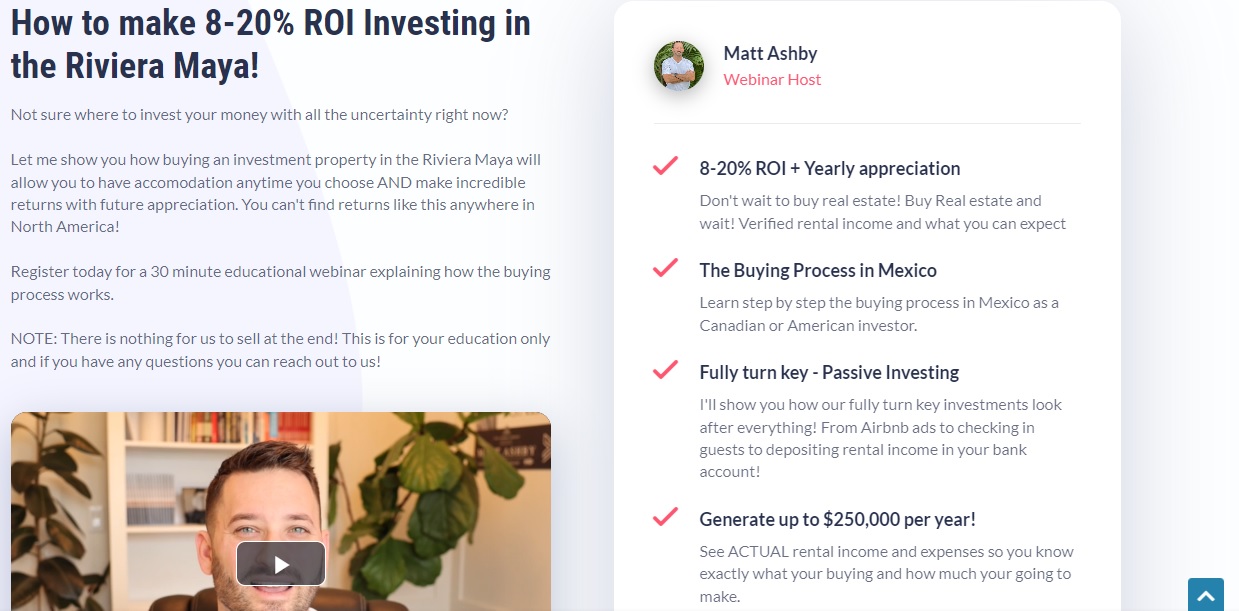

In unregulated real estate markets in the Caribbean companies can get away with saying anything they want to attract potential investors. There is no system of accountability. It is extremely important that you conduct your own due diligence on these companies (builders & brokers) to ensure that they have a good track record and their previous developments aren’t full of unhappy customers.

Beware of people stating that you can generate $250,000 USD in rental income per year.

Some companies will boast that the average ROI of their properties is up to 12%-13% per year.

False ROI Being Promoted In The Riviera Maya

18-25% ROI In The Riviera Maya Being Promoted – Caution!

75% ROI…REALLY!?

40% ROI In The Dominican Republic

If a certain percentage of ROI is being promised or insinuated then ask yourself these questions:

1. Is the location of the property on or near the beach? If it isn’t then the chance of you getting an outrageously high amount of ROI per year is slim.

2. The further the property is away from the beach the more complicated it is for the tourists to get around. Car rental fees can be high depending on the time of the year. Most tourists don’t want to spend 20-30 minutes driving to the beach in a country where they don’t speak the language and know the rules of the road.

3. If it is an unregulated real estate market how do these companies get their ROI figures? Do they have data they publish and can show you? Or are you supposed to take their word for it?

4. How do you investigate to find the satisfaction of the customers? Facebook groups for expats and real estate in that particular region, speak with agents, search on Google.

5. Ensure the building company has permits to begin construction before you reserve your condo with a $1,000 to $5,000 US Dollar deposit. What you don’t want to happen is the company not have permits and can’t begin construction on time. Being 5 months behind schedule on breaking ground means the entire project is pushed back. That means that investors aren’t going to begin earning ROI until much later.

6. If you are purchasing a property from a developer are you free to manage the property yourself? Or are they going to manage it for you for 2-3 years? The management fee is coming out of the ROI you are seeking. The average management fee in the Dominican Republic is between 15%-30%.

7. There is high season and low season. Low season affects your ROI. Distance to and from the beach affects your ROI. Management fees affect your ROI.

8. Be wary of companies with “Guaranteed X% ROI”. The only things that are guaranteed in life are death and taxes. Oh yeah, and some knee and back pain.

Cozy 2 Bedroom Townhouse In The British Virgin Islands

When you purchase a condo in a brand new development you need to pay attention to the contract. Always have the contract in English and Spanish and have a real estate attorney you trust to read over it and explain everything to you clearly. A reason for this is because the developer will not allow anyone to manage their condo themselves for the first 2 to 3 years. So the developer will be charging a management fee, along with other fees for the allotted time span. This eats into your expected ROI.

Great Opportunity For Airbnb in Beautiful Akumal, Mexico

Make sure you know ahead of signing the contract what fees you will be charged monthly. You don’t want to get your first statement from them and see a cleaning fee, processing fee, foreign transaction fee, management fee, currency conversion fee. or, maybe the developer just charges you one flat fee per month? Make sure you know ahead of time.

Here Is Another Great Opportunity To Buy Brand New In Tulum! Build Rental Income!

Closing

In closing, Caribbean real estate can be a crazy place if you don’t know the right questions to ask or what to be on the look out for. We are here to help you. We hope you got some value from this blog, feel free to share and reach out if you have any questions.

Make This A Weekly Activity Of Yours In The Caribbean!

Pingback:The Danger of Influencer "Real Estate Agents" - Ushombi

Pingback:Point2 Ceasing Caribbean Real Estate Operations - Ushombi

Pingback:Caribbean Real Estate ROI Myths Part 2