How To Purchase Caribbean Real Estate: Panama

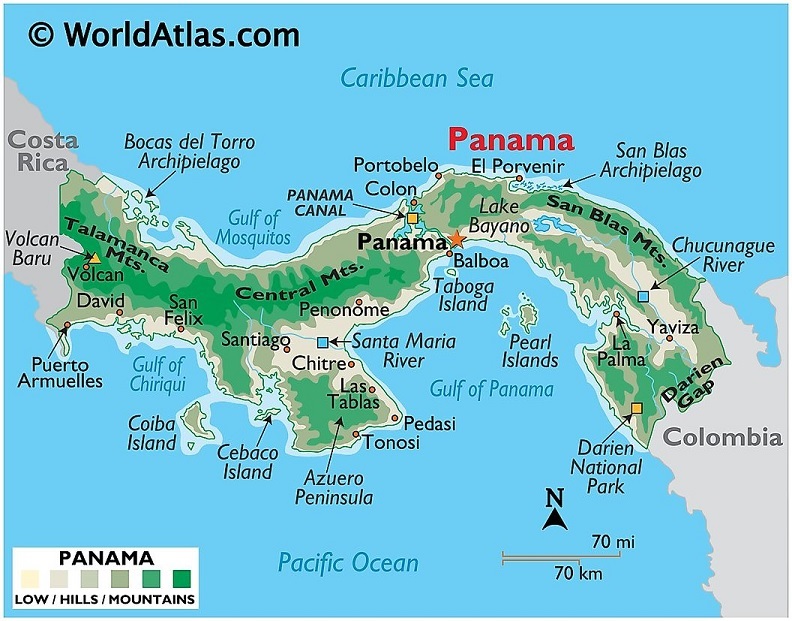

Panama is a country on the isthmus linking Central and South America. The Panama Canal, a famous feat of human engineering, cuts through its center, linking the Atlantic and Pacific oceans to create an essential shipping route. In the capital, Panama City, modern skyscrapers, casinos and nightclubs contrast with colonial buildings in the Casco Viejo district and the rainforest of Natural Metropolitan Park. Panama is a great option for investors looking to purchase Caribbean real estate.

We are always striving to bring value to Ushombi and save investors time when it comes to purchasing Caribbean real estate. We have partnered with a real estate law firm in Panama that has provided this outline for you. Ushombi has partnered with Emilio Cornejo Vernaza Founding Partner of PGS Legal in Panama City, Panama.

You can find PGS Legal on Facebook and on Instagram.

So let’s take a look at how you purchase real estate in Panama in the most tax efficient way possible. This outline was created by Emilio and these are things any investor needs to know before they purchase Caribbean real estate in Panama.

– Invest on property that benefits from property tax exemptions – Tax exemptions for 5, 10, 15 or even 20 years have been granted on the improvement or construction values of real estate.

– When applicable, file your property under the Main dwelling or Family Property regime – More advantageous tax rates will apply.

– Any national or foreign person, company or foundation may own real estate in Panama – However, in order to be able to sell, such foreign person, company or foundation must register a tax number in Panama.

– Buyers normally bear the costs of closing expenses – Sellers must pay all related transfer taxes.

* Avoid purchasing property in your personal name or under a corporation – transfer taxes triggered when selling would be unavoidable.

* Setup a private interest foundation instead – there are no transfer taxes to consider when reassigning management and benefit of a foundation.

* However, buying under your private name has its own benefits, as well. – Lower income tax rates apply for persons than for corporations or foundations.

– Purchasing real estate remotely is possible, either through a power of attorney or a resolution from a corporation or foundation – however setting up a local bank account to make payments is always advisable.

– Real estate investment starting at USD $200,000 may lead to a permanent residence status and later on to citizenship.

Some of the best neighborhoods to purchase real estate in Panama City are Casco Viejo, Costa del Este, Punta Pacifica and El Cangrejo. Make sure you explore all of your options and take full advantage of their resources when you are with the real estate agent, they should be knowledgeable and be able to provide figures of properties that have recently sold in that area.

This concludes our outline of the most tax advantageous way to purchase real estate in Panama. If you have any questions about purchasing Caribbean real estate or real estate in Panama then reach out to us.